Content

Why Revenue and Income Are Not the Same

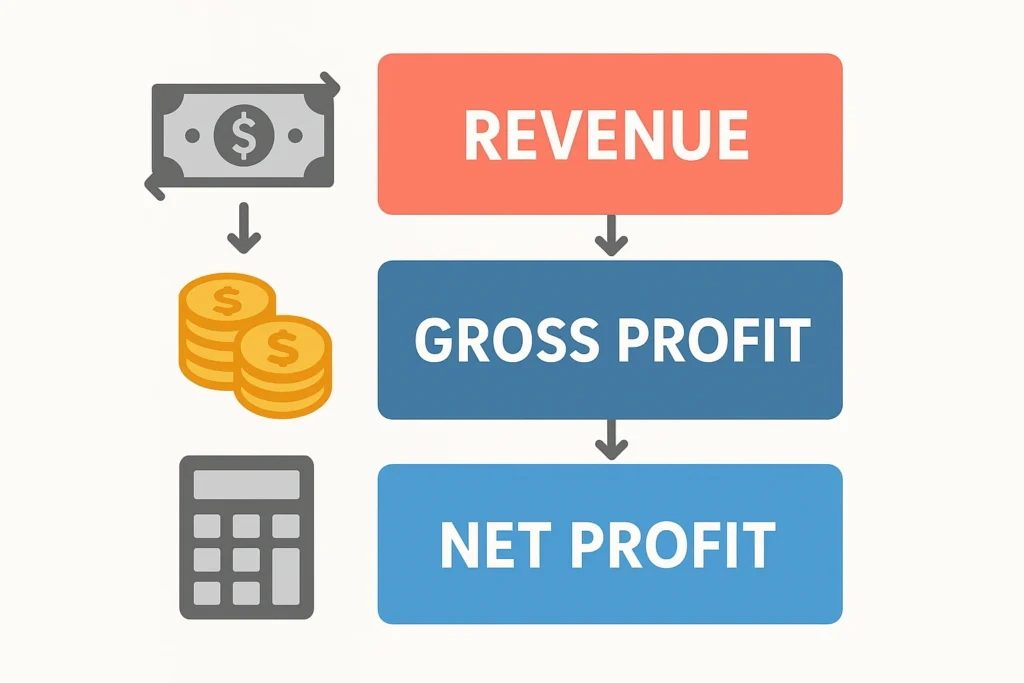

Basic Definitions: Revenue, Gross Profit, Net Profit

Entrepreneurs often confuse turnover with results. Revenue is the total amount of money received from sales over a period. However, it does not account for the costs of goods, advertising, salaries, and taxes. The next layer is gross profit: revenue minus cost of goods sold (purchases, production, logistics). But even gross profit does not reflect the real picture – there are still operating expenses, marketplace commissions, acquiring, rent, payroll funds, and depreciation.

Only net profit shows how much money is actually left in the business after all mandatory expenses and taxes. It makes sense to compare this with goals, investments, and dividends. If these levels are not separated, it is easy to fall into the illusion of “growth,” where turnover increases but margins decrease.

Typical Mistakes of Entrepreneurs When Assessing “Success” by Turnover

- Focus on turnover without analyzing profitability. Advertising campaigns inflate revenue but reduce the average markup.

- Ignoring hidden and deferred costs. Returns, post-facto discounts, manager bonuses, and courier shipments often do not make it into the initial calculation.

- Untimely accounting of expenses. When keeping records in spreadsheets, entrepreneurs record purchases later than sales and get “paper” profits that are not in the account.

- Mixing personal and business expenses. Money “for personal needs” is written off without being reflected in the accounts, and the owner thinks the profit is higher than it actually is.

- Lack of a single source of data. Different sales channels, multiple warehouses, and purchase currencies make it difficult to compile everything into one report without automation.

As long as a business measures success by revenue, it is blind to real cash flows. The solution is to regularly calculate real business income and generate profit reports by SKU, channels, and periods. This is where profit accounting in CRM with automatic margin and cost calculation, such as in HugeProfit, helps. In the following sections, we will examine what constitutes profit, why manual methods are outdated, and how financial analytics for small businesses becomes easier with the right tool.

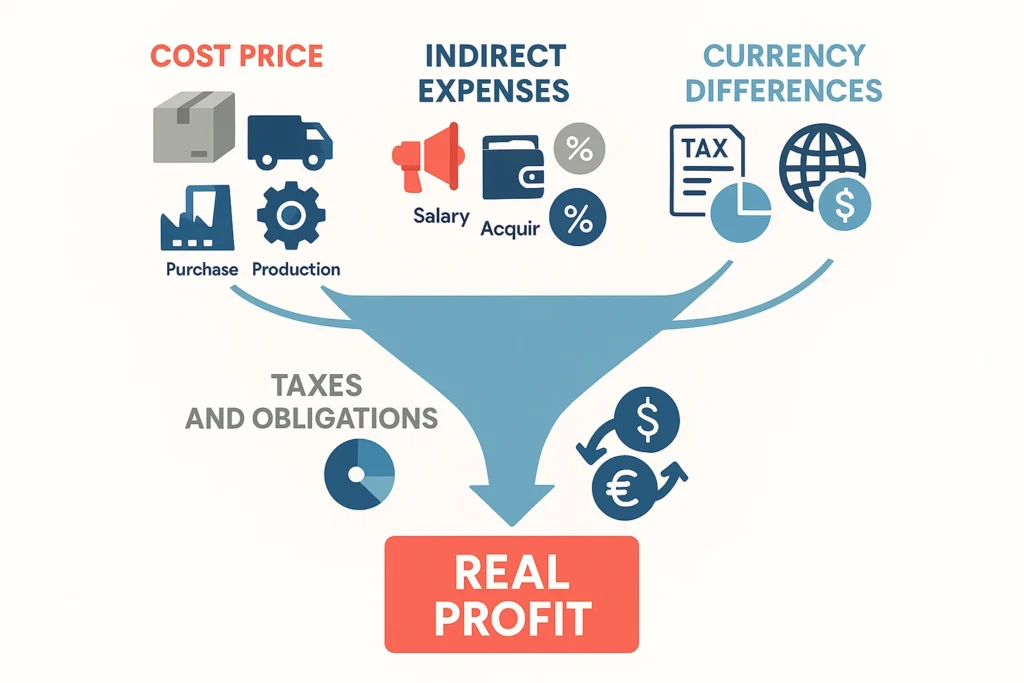

What Real Income Consists Of, or How to Calculate Real Income

Cost of Goods: Purchasing, Logistics, Production Costs

The heart of profit calculation is accurate cost of goods. This is not just the supplier’s price. Add logistics, customs, packaging, courier expenses, and consumables. If you produce, distribute raw materials, equipment depreciation, and workshop staff wages. Without this, the gross margin is “drawn” inflated, and the real business income is an illusion.

Indirect Costs: Marketing, Salaries, Marketplace Commissions, and Acquiring

Indirect costs impact margins as much as purchasing errors. Advertising (performance, context, SMM), manager salaries, rent, utilities, marketplace commissions, acquiring, and service subscriptions – all of this needs to be allocated to sales. In HugeProfit, such expenses can be distributed by items and channels to see profit accounting in CRM by SKU and traffic sources.

Taxes and Mandatory Payments: How They “Erode” Margin

Unified tax, VAT, ESC, bank commissions, payments for cash registers – many entrepreneurs account for them “sometime later.” But “later” is what eats into net profit. Include the tax burden in the pricing model and reports. Financial analytics for small businesses should show profit after taxes to make decisions about investments and dividends.

Returns, Discounts, and “Post-Facto” Adjustments

Product returns, warranty payments, discounts for regular customers, and call center bonuses are real money leaving the turnover. If they are not recorded immediately, the reporting is false. The system should automatically recalculate profitability after a return and adjust the period’s indicators.

Exchange Rate Differences and Multi-Currency Purchases

You buy in dollars and sell in hryvnia – the exchange rate difference affects profit. Accurate cost accounting at the rate on the date of receipt, not “on average per month,” is critical. In HugeProfit, you can enter purchases in different currencies and see the final profit in the base currency without manual recalculations.

Real income is formed not only by “price minus purchase.” It is a complex of direct and indirect costs, taxes, commissions, returns, and exchange rate differences. By automating these calculations in HugeProfit, you eliminate the human factor and get a transparent profit report – for each product, order, channel, and period. This is the basis of controlled profitability and sustainable growth.

Formulas and Metrics for Calculating Profit

Gross Margin, Operating Profit, and Net Profit

- Gross Profit = Revenue – Cost of Goods Sold (COGS).

Gross Margin = Gross Profit / Revenue × 100%. - Operating Profit = Gross Profit – Operating Expenses (marketing, salaries, rent, commissions).

- Net Profit = Operating Profit – Taxes – Other Mandatory Payments.

Tracking these levels gives an understanding of where money is “lost”: in purchases, advertising, or at the tax level. For small businesses, it is critical to control profitability and cost and automate calculations at each step – this is where profit accounting in CRM HugeProfit helps.

LTV, CAC, and ROI: Linking Marketing to Profit

- CAC (Customer Acquisition Cost) – the cost of attracting a customer. Calculate all marketing expenses for the period / number of new customers.

- LTV (Lifetime Value) – the profit a customer brings over the entire relationship period. Formula (simplified):

LTV = Average Check × Average Number of Purchases × Average Margin. - ROI (Return on Investment) for campaigns:

ROI = (Campaign Profit – Campaign Costs) / Costs × 100%.

If LTV ≤ CAC, the business is eating into future margins. Financial analytics for small businesses should show these metrics automatically to manage the advertising budget.

Calculation Example on a Real Case (Step-by-Step)

Let’s assume an online store for June:

- Revenue: 1,000,000 UAH.

- Cost of Goods Sold (COGS): 620,000 UAH (purchases + delivery + packaging).

- Gross Profit = 1,000,000 – 620,000 = 380,000 UAH.

- Gross Margin = 38%.

- Operating Expenses:

- Advertising: 90,000 UAH

- Manager Salaries: 60,000 UAH

- Marketplace/Acquiring Commissions: 30,000 UAH

- Other: 20,000 UAH

Total: 200,000 UAH. - Operating Profit = 380,000 – 200,000 = 180,000 UAH.

- Taxes and Mandatory Payments: 45,000 UAH.

- Net Profit = 180,000 – 45,000 = 135,000 UAH.

Suppose 300 new customers were attracted, and marketing cost 90,000 UAH.

- CAC = 90,000 / 300 = 300 UAH.

Average Check = 1,000,000 / (number of orders). If there are 1,250 orders, the average check = 800 UAH.

Average Margin = 38% → 304 UAH margin per order.

LTV (if the average number of purchases is 2.1) = 800 × 2.1 × 0.38 = 638 UAH.

ROI for advertising = (Profit attributable to advertising – 90,000) / 90,000 × 100%. If advertising generated 180,000 UAH in gross profit → ROI = (180,000 – 90,000) / 90,000 × 100% = 100%.

Why Automatic Profit Calculation Is Needed

Manual calculation of such metrics in Excel leads to errors and “delays.” Automatic profit calculation in HugeProfit accounts for currencies, returns, allocates indirect expenses, and immediately shows real business income in convenient reports. You see where the margin is falling, which traffic channels are unprofitable, and can quickly adjust the strategy.

Why Excel and “Mental Accounting” No Longer Work

Manual Errors and Data Loss

Spreadsheets grow, links break, formulas “slip.” One incorrect range – and real business income is distorted. Files are sent by email, versions conflict, and access is lost. As a result, the owner sees yesterday’s profit and makes decisions blindly.

Limited Reports and Lack of Relevance

Excel does not “know” about new orders, returns, or marketplace commissions until someone manually enters the data. There is no online update or end-to-end analytics. To calculate profitability and cost by SKU or sales channel, complex pivot tables are needed, which quickly become unsustainable.

Fragmentation of Information Sources

Sales on marketplaces, websites, Instagram; purchases in different currencies; advertising expenses in multiple ad accounts – all this lives in separate files. Without a unified system, it is easy to “lose” an expense item or duplicate a shipment. Profit accounting in CRM solves this problem through a single database and automatic synchronization.

Lack of Role Control and Process Transparency

In Excel, it is impossible to flexibly restrict access rights, log changes, or control the correctness of entered data. A manager’s error can be discovered months later when the money is already gone. The system should record every action and provide an audit trail.

Impossibility of Scaling and Automation

When the number of orders exceeds one hundred per day, manual distribution of expenses and reconciliation of balances become routine, consuming time and increasing the risk of errors. Automatic rules, distribution of indirect costs, and recalculation of margins after returns are not done by Excel itself.

Excel is useful for drafts and quick calculations but not for management accounting. To see financial analytics for small businesses in real-time and make decisions based on facts, you need a tool that:

- automatically pulls sales, purchases, commissions, and taxes;

- recalculates profit after each operation;

- shows reports by products, channels, and periods.

Such a tool becomes HugeProfit: the system combines data, eliminates manual errors, and ensures automatic profit calculation. Next, we will examine how exactly HugeProfit helps calculate profit “for real.”

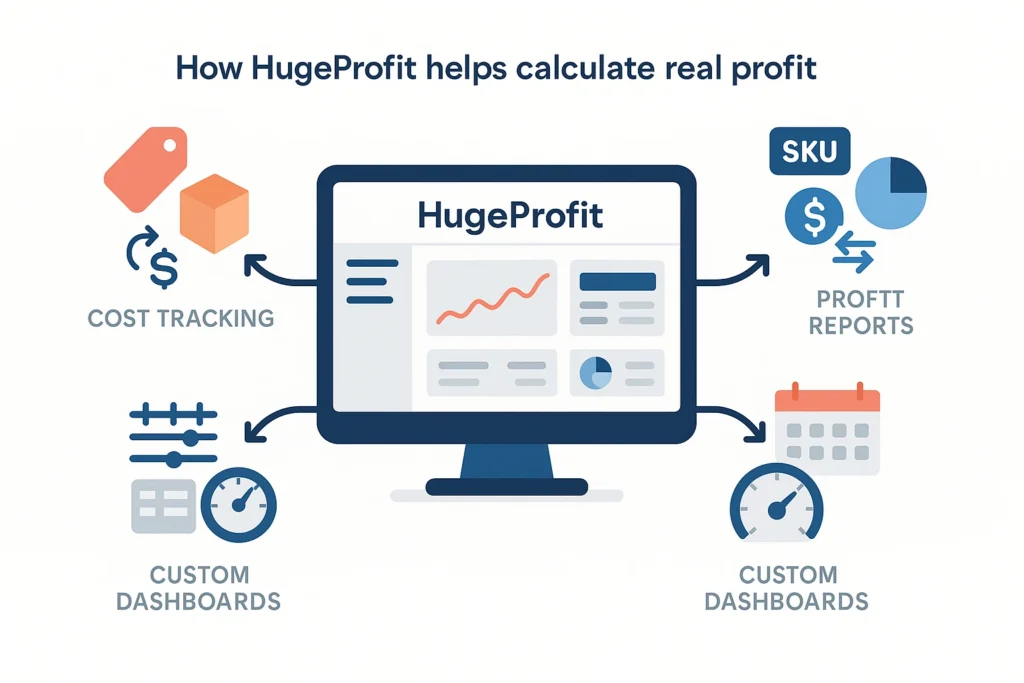

How HugeProfit Helps Calculate Real Income

Automatic Accounting of Cost and Multi-Currency Purchases

HugeProfit allows you to set different supply prices, account for logistics, packaging, courier expenses, and exchange rate differences. The cost is fixed at the time of receipt of the goods, not “at the average temperature for the month,” so profitability and cost are calculated correctly for each SKU and order.

Accounting for Expenses for Each Order and Product

Marketplace commissions, acquiring, manager bonuses, advertising budgets – you distribute them by items and channels. The system automatically “allocates” expenses to sales, so reports show real business income, not “paper profit.”

Flexible Profit Reports: SKU, Channels, Periods

In HugeProfit, reports are available by products, categories, customers, traffic sources, and time intervals. You see which items are dragging down the margin and which channels provide the best ROI. This is financial analytics for small businesses, where not just revenue but net profit is important.

Real-Time Margin Control

The system signals if the margin falls below a set threshold: for example, due to a discount or an increase in the purchase price. You immediately see the “red zones” and can adjust the price, campaign, or purchase terms.

Returns, Discounts, Profit Recalculation – Without Manual Routine

Any return automatically recalculates the profit for the period and the specific product. Discounts, bonuses, and retroactive adjustments – the system instantly reflects them in financial indicators. There is no misalignment between sales and actual money.

Integrations and a Single Source of Data

Marketplaces, online stores, cash registers, and payment systems – everything is pulled into one circuit. You don’t need to reconcile dozens of tables: profit accounting in CRM is maintained in a single database, without duplication or data loss.

Customizable Dashboards and KPIs

Choose key metrics (gross/net profit, CAC, LTV, ROI) and assemble dashboards for your tasks. The manager sees the “picture of the day,” the manager sees their KPIs, and the accountant sees correct reports for taxes.

HugeProfit addresses the entrepreneur’s main pain point – “where is my money?” Thanks to automatic accounting of cost, expenses, and taxes, you always see real profit, not just turnover. Next, we will step-by-step examine how to implement the system and configure reporting for your business.

Mobile applications of the CRM system HugeProfit

Use all the advantages of a mobile device for inventory management:

– mobile barcode scanner

– adding sales in 2 clicks

– creating and tracking TTN

– controlling balances on Prom, Rozetka, OpenCart, Woocommerce, Khoroshop

– Many warehouses and employees

Implementing HugeProfit: Step-by-Step Plan

Setting Up Catalogs, Warehouses, and Cost

The first step is to organize the nomenclature. Import goods with article numbers, SKUs, and variations. Set up warehouses (offline store, fulfillment, marketplace), specify units of measurement. Enter purchase prices for each batch: logistics, packaging, customs payments – include everything in the cost. This way, you immediately see real business income, not an “averaged” margin. If there are multi-currency purchases, fix the exchange rate on the date of receipt so that profitability and cost are calculated correctly.

Connecting Sales Channels and Expense Sources

Integrate marketplaces, online stores, cash registers, and payment services. Then connect advertising accounts and set up expense items: marketing, commissions, salaries. In HugeProfit, you can distribute expenses by channels and products, turning “turnovers” into profit accounting in CRM. This provides the basis for financial analytics for small businesses: you know where you earn and where you just “drive turnover.”

Setting Up Rules for Distributing Indirect Costs

Determine how to allocate marketing and operating costs: proportionally to revenue, the number of orders, or margin. Create automatic rules so that the system, without human intervention, “allocates” expenses to each sale. This eliminates manual routine and ensures automatic profit calculation in real-time.

Configuring Financial Reports and Dashboards

Choose key reports: profit by SKU, categories, channels; margin dynamics; LTV/CAC by traffic sources. Assemble dashboards by roles: the owner sees net profit and cash flow, the marketer sees ROI and LTV, and the accountant sees taxes and mandatory payments. Set up notifications for margin declines or cost increases.

Importing Historical Data and Validation

To see trends, upload past sales, purchases, and expenses. Conduct a reconciliation: does the final profit match your accounting and bank statements? Correct discrepancies – this will increase confidence in the system and provide a clean starting point.

Training the Team and Data Entry Regulations

Even the best system won’t save you if data is entered chaotically. Conduct training for sales managers, purchasers, and accountants: who, when, and what to record. Define the procedure for closing the period: checking returns, write-offs, taxes. Set up access rights and an audit trail to exclude errors and “manual adjustments without traces.”

Test Period and Adjustment of Settings

For the first month, work in “double-check” mode: manually verify automatic reports selectively. If necessary, clarify the rules for distributing expenses and adjust income/expense items. The goal is to ensure that reports in HugeProfit match the actual movement of money.

Transition to Data-Driven Management Decisions

When the system is debugged, use the reports to make decisions:

- Increase the price for SKUs with a declining margin.

- Disconnect the unprofitable traffic channel or revise the advertising.

- Transfer purchases to a supplier with better terms.

- Optimize taxes and payment schedules.

Implementing HugeProfit is not just a “connect and forget” process. It is methodical work: setting up directories, integrations, cost distribution rules, and regulations. The result is transparent accounting, real business income in reports, and confidence that every percentage of margin is under control. Ready to move on to the checklist and final conclusions?

Key Conclusions and Entrepreneur Checklist

7 Steps to Controlling Real Income

- Separate revenue and profit. Record revenue, gross, operating, and net profit separately.

- Account for full cost. Purchases + logistics + packaging + courier + exchange rate differences – everything is included in COGS.

- Distribute indirect expenses. Marketing, commissions, salaries, and taxes should be “allocated” to sales according to rules, not “after the report.”

- Automate calculations. Abandon Excel as the main accounting system – use CRM/ERP with automatic margin recalculation.

- Monitor LTV, CAC, ROI metrics. Link marketing to real profit, not clicks and reach.

- Control profitability in real-time. Set thresholds and notifications to catch profit “dips” immediately.

- Create regulations and roles. Determine who enters what, how the period is closed, and how reports are verified.

Call to Action: Start Calculating Profit in HugeProfit Today

If you’re tired of “paper profits” and don’t understand where the margin is going – connect HugeProfit. The service automates cost accounting, expense distribution, and taxes, showing real business income by products, channels, and periods.

- Set up catalogs and warehouses.

- Connect marketplaces and cash registers.

- Launch profit and margin reports.

Conclusion: Profit is not “revenue minus something.” It is a managed process that requires precise accounting and transparent analytics. HugeProfit gives you the tool to see the whole picture and make decisions based on facts, not guesses.

Choose the best plan and grow your business with us

Free

Confident

Experienced

Pro

Join us on Facebook 😉