Cost accounting in Ukraine is one of the most critical control areas for commodity businesses: any mistake here instantly distorts the price, margin, taxes, and management decisions. In practice, companies regularly make the same mistakes: they calculate the cost only by the purchase price, mix calculation methods (FIFO/weighted average), ignore exchange differences, disconnect inventory accounting from online/offline sales, and continue to manage everything in Excel without roles, change logs, and KPIs.

In this article, we will analyze the top 5 typical mistakes in cost accounting, show their financial consequences, and explain how HugeProfit addresses each of these risk points: from automatic distribution of indirect costs and multicurrency accounting to strict fixation of the cost calculation method, real-time warehouse synchronization, and transparent margin analytics. The goal is to provide you with a practical action plan to stop losing profits “in the details” and move to managing the business economy based on accurate data.

Content

Why Cost Accounting in Ukraine is Critical for Business

Impact of Cost Accounting Errors on Price, Margin, and Taxes

Errors in calculating cost lead to direct distortions in price, margin, SKU profitability, and management reporting. Overestimated cost – you lose sales due to an uncompetitive price. Underestimated – it seems that the margin is high, but in fact, the business is “eating up” money and underpaying taxes, risking additional charges.

Classic consequences:

- Incorrect ROI of advertising campaigns and wrong decisions to disconnect profitable channels;

- “Floating” gross and operating profit, making it impossible to build a KPI system;

- Incorrect assessment of inventory, which disrupts procurement financing and cash flow.

HugeProfit fixes the cost calculation method, automatically pulls all cost components, and provides margin reports by products, channels, managers, and periods.

Multicurrency and Exchange Differences as a Reality of the Ukrainian Market

The Ukrainian commodity business almost always deals with purchases in currency and sales in hryvnia. If you do not account for exchange differences, you do not see the real profit. An error at the stage of revaluing inventories or using the “average monthly rate” distorts the net profit, especially during volatility.

HugeProfit allows:

- Account for purchases at different rates and fix the date of cost formation;

- Automatically reflect inventory revaluation and its impact on P&L;

- See the real margin considering currency dynamics.

This eliminates manual recalculations and removes the risk of “beautiful” accounting profits with an actual decrease in operating margin.

Why Excel Can No Longer Handle: Speed, Scale, Transparency

When you have multiple sales channels, different batches for one SKU, returns, reserves, marketplace commissions, Excel becomes a risk zone:

- No change log and access control – any file can be “adjusted”;

- High probability of human errors in copy-pasting and pivot tables;

- Cost calculations by FIFO or weighted average cannot be maintained in real time;

- Margin reports are built slowly and are not replicable.

HugeProfit provides a centralized accounting circuit, automates formulas, records operations in the system, and ensures data transparency for the owner and CFO.

The Role of Automation: Why HugeProfit Reduces the Human Factor

The key to sustainable cost accounting is rules and automation, not “accountant heroism.” HugeProfit:

- Fixes the cost calculation method (FIFO, weighted average, etc.) and prevents “jumping” between them;

- Automatically distributes indirect costs across products or batches according to specified algorithms;

- Synchronizes warehouses, cash registers, marketplaces, and online stores in real time, eliminating gaps between accounting and sales;

- Provides KPIs for margin, change log, control of roles and access, minimizing the risk of manipulations and errors.

Without a systematic approach to cost accounting in Ukraine, a business lives in the illusion of profit. HugeProfit turns calculations from “manual chaos” into a strict, transparent, and repeatable procedure on which you can safely scale.

Mistake 1: Calculating Cost Only by Purchase Price

Ignoring Logistics, Marketplace Commissions, and Packaging

Most companies limit themselves to the purchase price, forgetting to include delivery, customs, marketplace commissions, acquiring, packaging, picking, and other direct costs. As a result, cost accounting in Ukraine is distorted, and the margin at the SKU level appears higher than it actually is. HugeProfit allows setting rules for the automatic distribution of such costs across batches, products, or documents so that the automatic cost calculation is complete and repeatable.

Indirect Costs (Salaries, Rent, Advertising): How to Distribute Them Correctly

Payroll, rent, advertising, CRM services, logistics between warehouses, and other indirect costs often remain “outside” the cost. This leads to inflated “paper” profits. In HugeProfit, indirect costs are distributed across products or groups of products according to customizable drivers: turnover, number of units, marginal contribution, volume. This provides honest margin and profit control and helps not to “eat up” income with invisible expenses.

Errors in Kits and Sets: Distribution of Component Costs

When creating kits, sets, bundles, many companies calculate the cost based on the price of one of the components or do not recalculate at all. As a result, the accounting of kits in profit reports is distorted. HugeProfit automatically redistributes the cost of components within the kit and correctly calculates the gross and operating profit for each SKU.

How HugeProfit Automates the Distribution of Indirect Costs

The HugeProfit service for CRM for commodity business:

- Sets distribution rules for direct and indirect costs according to selected algorithms;

- Considers different currencies and rates, fixing the correct cost on the date of the operation;

- Supports different batches and calculation methods (FIFO, weighted average, etc.);

- Generates margin reports by SKU, channels, managers, periods;

- Eliminates manual Excel errors and ensures data transparency for the owner and CFO.

Result: You stop “forgetting” expenses, see the real picture of profit for each product, and manage the business based on accurate figures, not feelings.

Mobile applications of the CRM system HugeProfit

Use all the advantages of a mobile device for inventory management:

– mobile barcode scanner

– adding sales in 2 clicks

– creating and tracking TTN

– controlling balances on Prom, Rozetka, OpenCart, Woocommerce, Khoroshop

– Many warehouses and employees

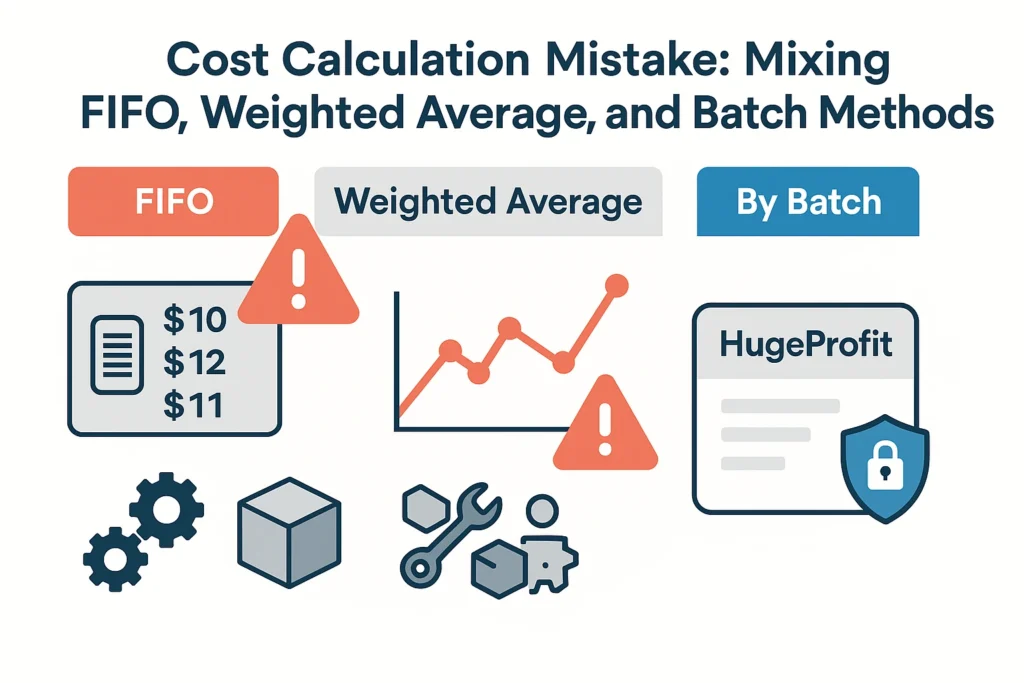

Mistake 2: Mixing Cost Calculation Methods (FIFO, Weighted Average, by Batch)

When to Use FIFO and When Weighted Average: Impact on Reporting and Margin

The choice of method directly affects margin, gross profit, and the tax base. FIFO more accurately reflects the cost during high inflation and exchange rate volatility because it writes off the earliest purchases. Weighted average simplifies accounting but “smooths out” the actual cost and can mask the decline in margin in a rapidly appreciating market. For production or batch completion, the “by batch” method provides transparency within a specific cycle. The business mistake is to use different methods for the same operations or “switch” between them for beautiful reports. HugeProfit fixes the method at the company or nomenclature level and does not allow changing the rules retroactively, ensuring data comparability.

Different Purchase Prices for the Same SKU: How Not to Lose Accuracy

The same SKU arrives in batches at different purchase prices, in different currencies, and with different logistics. If the method is not fixed and movement is managed manually, the cost begins to “float”: one day the product is loss-making, the next day it is super-profitable. HugeProfit supports automatic cost calculation by FIFO, weighted average, and batch model, considers multicurrency and additional costs, and stores the complete history of movement for each batch. This provides transparent cost accounting in Ukraine and normal margin and profit control for each SKU.

Cost in Production, Completion, and Assembly of Kits

In own production, completion, or assembly of sets, it is important to correctly collect direct and indirect costs, distribute them across products, and not mix methods: FIFO can be applied to raw materials, and batch accounting to finished products. The mistake is to apply the weighted average to the entire cycle, ignoring the actual cost structure. HugeProfit allows setting rules for the distribution of indirect costs, calculating the cost of semi-finished and finished products, and fixing the method at each stage to maintain accuracy and not distort reporting.

How HugeProfit Fixes the Method and Prevents “Jumping” Between Rules

The key practice is that the calculation method should be fixed by the accounting policy and technically recorded in the system. In HugeProfit:

- The method is determined at the company, group of goods, or specific SKU level and cannot be changed retroactively;

- Each write-off transparently indicates by which batch or formula it passed;

- Any adjustments (inventories, returns, revaluations) are immediately reflected in the cost and visible in the change log;

- Access and roles exclude manual “tweaks” in Excel;

- Margin reports are built in a single logic, providing comparability of periods and KPIs for the owner and CFO.

Uniform, reproducible, and transparent cost accounting in Ukraine without “cosmetic” figures and with full traceability of decisions. This is the basis for scaling, adequate pricing, and management reporting protected from errors.

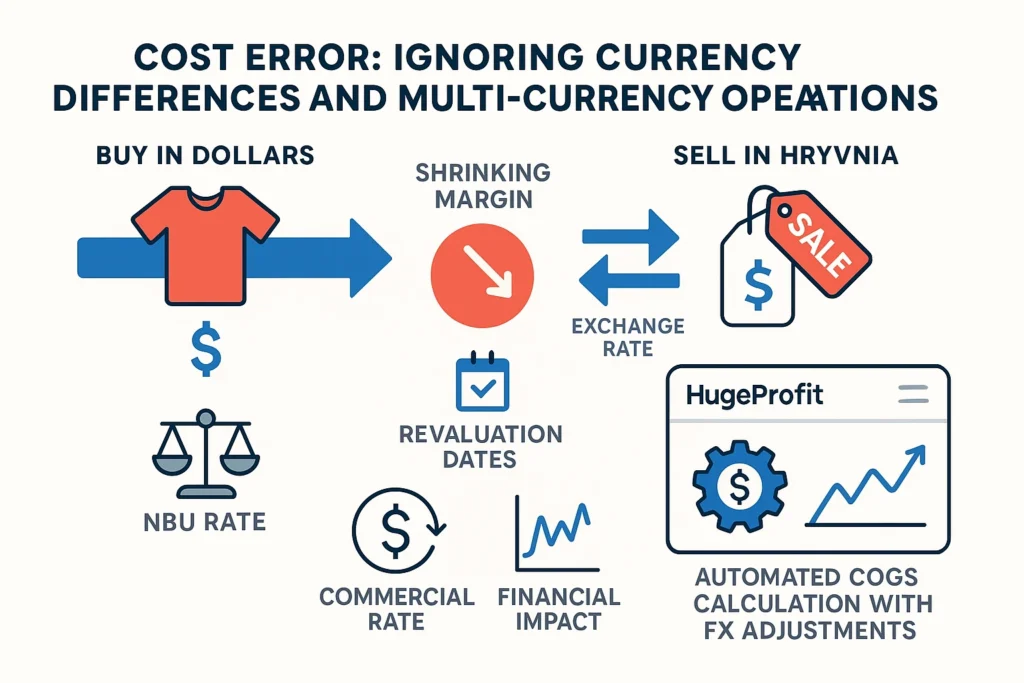

Mistake 3: Ignoring Exchange Differences and Multicurrency Operations

Purchasing in Currency, Selling in Hryvnia: Where the Margin is Lost

Ignoring exchange differences leads to the business seeing “paper” profits instead of real ones. The product is bought in dollars or euros, sold in hryvnia, the exchange rate rises – but the cost remains at the old rate. As a result, the margin for SKUs and sales channels is overstated, management decisions are made based on distorted data, and tax risks increase. HugeProfit fixes the rate on the date of each operation and automatically recalculates cost accounting in Ukraine in a multicurrency environment.

NBU Rates, Commercial Rates, and Revaluation Date

Typical mistakes:

- Using the “average monthly rate” instead of the rate on the date of each purchase or write-off;

- Not fixing at which exact rate the cost is calculated;

- Ignoring the need for inventory revaluation during volatility.

In HugeProfit, rules are set: which rate to take (NBU, commercial, user), at what moment to fix it, and when to perform the revaluation. This provides correct gross and operating profit and honest margin and profit control.

Inventory Revaluation and Its Impact on Financial Results

If the exchange rate rises but the inventories are not revalued, the reporting shows a profit higher than the actual. If the exchange rate falls, you can overestimate the cost and “choke” the margin. HugeProfit:

- Supports automatic or manual inventory revaluation with the fixation of date and rate;

- Reflects the impact of revaluation on P&L and margin reports;

- Maintains a transparent change log so that the owner and CFO can see who and when adjusted the data.

How HugeProfit Calculates Cost Considering Exchange Differences Automatically

HugeProfit implements the full cycle of multicurrency accounting:

- Fixes the currency and rate in each purchase, write-off, return document;

- Calculates the cost by the selected method (FIFO, weighted average, by batch) considering currency fluctuations;

- Performs inventory revaluation and recalculates the margin automatically;

- Shows margin and profit control by products, channels, managers, and periods already in hryvnia, considering all exchange differences;

- Eliminates manual recalculations in Excel and minimizes the human factor.

As a result, you will see the real profit – correctly form prices and protect your business from erroneous management decisions in a volatile market.

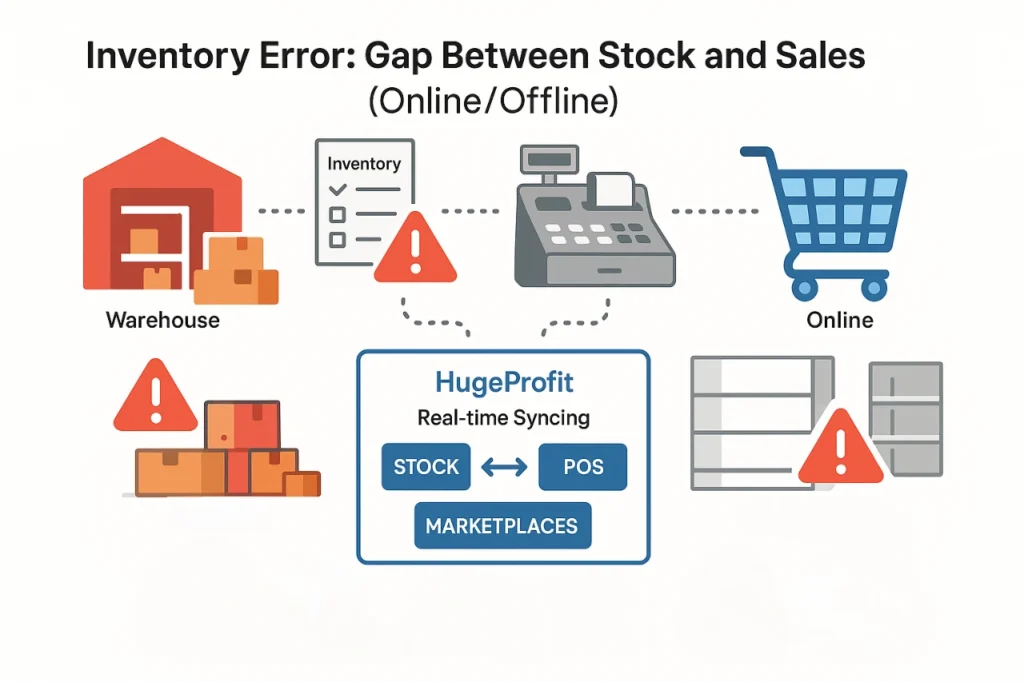

Mistake 4: The Gap Between Warehouse Accounting and Sales (Online/Offline)

Inventories “For Show”: Why They Do Not Catch Errors in Cost

Formal inventories without comparing batches, reserves, returns, and movements do not identify systemic discrepancies. As a result, cost and inventories live separately from reality, and margin and profit control becomes a fiction. Reasons:

- Inventory is conducted post factum and without blocking operations;

- Batches and write-off methods (FIFO, weighted average) are not reconciled;

- Adjustments are entered manually and not reflected in margin reports;

- There is no change log and responsibility for data correctness.

HugeProfit records each operation, saves the history of adjustments, and allows conducting inventories with automatic recalculation of cost and transparent tracing.

Reserves, Movements, Discounts: What Is Most Often Forgotten to Account For

Common “gaps” in cost accounting in Ukraine:

- Reserves for orders do not block the product, and it is sold again – cost and inventories “float”;

- Internal movements between warehouses occur without the correct transfer of cost;

- Discounts and promo campaigns do not recalculate the margin by SKU and channels;

- Kits and unkitting do not transfer the correct cost of components.

In HugeProfit, reserves are documented, movements and discounts are automatically reflected in the cost, and kits are recalculated considering the cost of each item.

Returns and Warranty: How to Correctly Return Cost and Margin

Errors with returns lead to double distortion: in the warehouse (inventories are not correctly restored) and in finance (the margin from the sale remains, although the money was returned). The correct process includes:

- Return of the product with the restoration of cost by the original batch or method;

- Adjustment of gross profit and P&L for the return period;

- Reflection of expenses for diagnostics, logistics, repair.

HugeProfit conducts returns in the same circuit as sales, automatically adjusts the margin, and does not allow “forgetting” indirect costs.

How HugeProfit Synchronizes Warehouses, Cash Registers, and Marketplaces in Real Time

The root cause of the gap is that data lives in different systems: marketplaces, online store, cash registers, Excel. HugeProfit solves this by:

- Single circuit: CRM for commodity business + warehouse + finance + analytics;

- Integrations with Prom, Rozetka, OpenCart, WooCommerce, Horoshop, Shop-Express, cash registers, and messengers – orders immediately enter the system;

- Reserves, write-offs, returns, movements are reflected instantly, considering the selected cost calculation method;

- Change log, roles, and access rights exclude “manual tweaks”;

- Reports on margin by SKU, channels, managers, and periods are built on unified data without manual consolidation.

Result: You get continuous, synchronized accounting without Excel chaos, see real profits for each product and channel, and can scale without the risk of “divergence” of warehouses and finances.

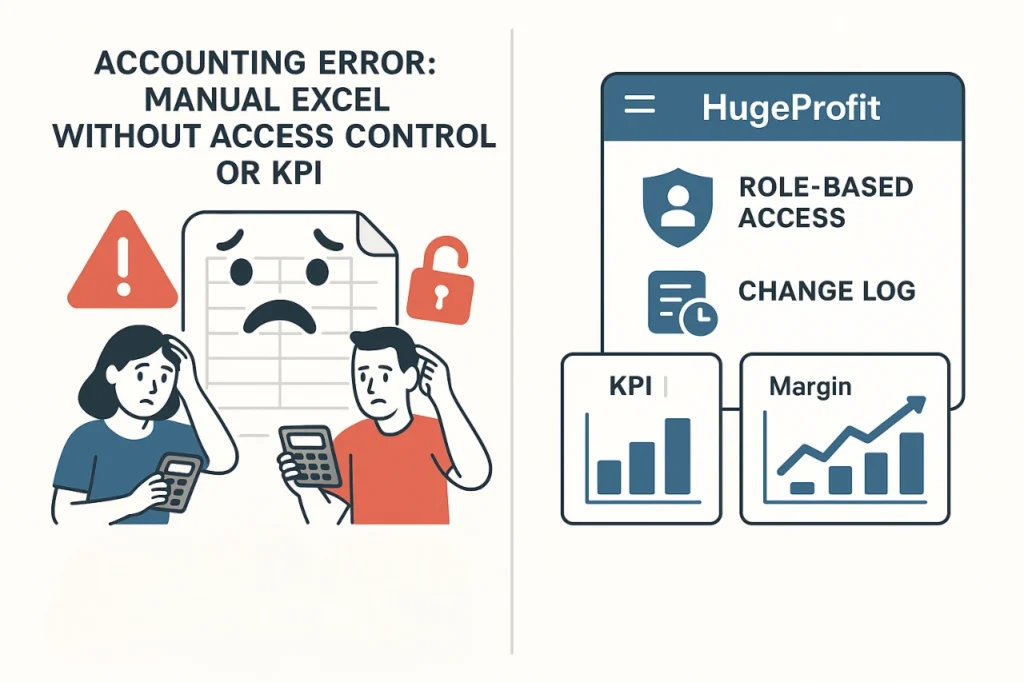

Mistake 5: Manual Accounting in Excel Without Checks, Access Rights, and KPI

Human Factor and Lack of Change Traceability

Manual tables = high probability of copy-paste errors, loss of formulas, accidental overwrites. It is impossible to quickly understand who, when, and what exactly was changed. As a result:

- Cost, margin, and final profit are distorted;

- It is impossible to restore correct data for management or tax reporting;

- The owner and CFO have to trust the figures “on their word”.

HugeProfit records every action in the change log, stores document history, and ensures data transparency for audits and management decisions.

No Centralization: Everyone Counts in Their Own Way

When different departments have their own Excel files, different versions of the truth emerge:

- Different cost calculation methods (FIFO, weighted average, by batch) are applied chaotically;

- Indirect costs (payroll, rent, advertising) are not distributed uniformly;

- Returns are accounted for in one file but not in another;

- Marketplaces, cash registers, online stores live separately from warehouse accounting.

HugeProfit provides a single cost accounting circuit in Ukraine: warehouses, purchases, sales, returns, revaluations, cost, P&L, and margin and profit control – in one system and according to uniform rules.

Zero Analytics by Products, Channels, and Managers

Excel does not provide stable, replicable margin analytics in real time:

- Reports are built manually and differently each time;

- It is impossible to quickly break down profits by SKU, categories, channels, managers, periods;

- Decision-making on pricing, promotions, and purchases is delayed or done based on “feelings”.

In HugeProfit, automatic cost calculation and ready-made margin dashboards, ABC/XYZ analysis, reports on profit dynamics, and unprofitable SKUs are available without manual compilation.

How HugeProfit Provides Role Control, Change Log, and KPI for Margin

HugeProfit addresses all key risks of manual Excel accounting:

- Roles and access rights – everyone sees and changes only what they are allowed to;

- Change log – who, when, in which document, and what was changed;

- Fixed cost calculation method (FIFO, weighted average, by batch) – without “jumps” for beautiful figures;

- Automatic distribution of indirect costs according to algorithms (turnover, quantity, marginal contribution, etc.);

- Multicurrency, inventory revaluation, exchange differences – without manual recalculations;

- KPI for margin by products, managers, channels, and periods – for daily management control.

Rejection of Excel chaos and transition to a transparent, secure, and reproducible accounting model. You see real money, not “knee-jerk” figures, and can scale the business without losing control.

Results

- The top 5 mistakes in cost accounting in Ukraine are repeated by most commodity businesses: calculation only by the purchase price, mixing methods (FIFO, weighted average, by batch), ignoring exchange differences, the gap between warehouse and sales, as well as manual accounting in Excel without roles, change log, and KPI.

- Each of these mistakes leads to distortion of margin, P&L, incorrect pricing, and risky management decisions.

- HugeProfit addresses all critical points: fixes the cost calculation method, automates the distribution of direct and indirect costs, considers multicurrency and inventory revaluation, synchronizes warehouses and sales channels in real time, provides margin and profit control by SKU, channels, managers, and periods, as well as change log and access differentiation.

- The result is transparent, comparable, and reproducible data on which to safely build scaling, marketing investments, and pricing strategy.

What to Do Next: A Short Implementation Checklist

- Fix the cost calculation method (FIFO, weighted average, by batch) – once and for all, at the level of accounting policy.

- Automate the distribution of indirect costs by products and batches according to clear drivers (turnover, units, marginal contribution, etc.).

- Include multicurrency accounting and inventory revaluation – fix the rate and date of the operation, recalculate inventories and margin.

- Synchronize online and offline circuits: marketplaces, online store, cash registers, warehouses, returns, reserves – in one place and in real time.

- Refuse Excel chaos: roles, rights, change log, margin KPIs should be controlled by the system, not files.

- Include regular margin analytics by SKU, categories, channels, managers – for operational decisions and profit control.

Want to eliminate errors, see real profits, and stop “tweaking” cost in Excel?

Connect HugeProfit: we will audit your current accounting, fix the cost calculation method, automate multicurrency, indirect costs, and synchronize all sales channels.

Choose the best plan and grow your business with us

Free

Confident

Experienced

Pro

Join us on Facebook 😉