Maintaining financial records is not just an obligation, but a strategic advantage for every entrepreneur. That is why the income and expense ledger should become an important part of the business’s daily operations. It not only ensures compliance with tax legislation requirements but also allows the entrepreneur to monitor cash flow, analyze expenses, and make informed financial decisions.

In this article, we will explore how to properly maintain an accounting ledger, what mandatory details it should contain, who is required to fill it out, and how digital tools like HugeProfit can help make accounting transparent, fast, and maximally convenient.

Definition and Purpose of the Income and Expense Ledger

The income and expense ledger is a mandatory financial report for every individual entrepreneur or legal entity, where all income and expenses are recorded for the selected reporting period. The document is an important part of the accounting system, which allows tax authorities to assess the amount of taxable income.

The income and expense ledger reflects:

- all receipts of funds;

- business expenses;

- sales of goods and services;

- any economic operations.

The main functions of the income ledger include:

- calculating the amount of personal income tax (PIT);

- preparing for the annual tax return;

- monitoring business activities by government agencies;

- controlling cash income, especially for individual entrepreneurs who do not use cash registers.

Who Must Maintain the Income and Expense Ledger and How to Do It Without Errors

All individual entrepreneurs must maintain an income ledger. Exceptions may apply only to the form and method of its completion, depending on the taxpayer’s group. In particular, entrepreneurs on the general taxation system must adhere to established norms when filling out this document.

However, the income and expense ledger is useful not just as a formality. It is an effective tool for analyzing financial indicators and internal control. Regular analysis of the entries in the ledger helps the entrepreneur to timely identify weaknesses in finances and make informed decisions.

To avoid difficulties with manual completion or working in Excel, it is worth paying attention to modern digital solutions. For example, the HugeProfit CRM system allows you to automate the maintenance of financial reporting. Instead of spending time daily on manual data entry, you will get:

- automatic formation of the income and expense ledger;

- visualization of key financial indicators;

- preservation of the complete history of operations;

- access to analytics from any device.

HugeProfit is not just an alternative to Excel; it is a comprehensive system that covers accounting, analysis, and management of cash flows in the business.

Thus, maintaining an income and expense ledger is not just a legislative requirement but also a reliable way to manage business finances.

How to Maintain the Income and Expense Ledger: Rules and Tips

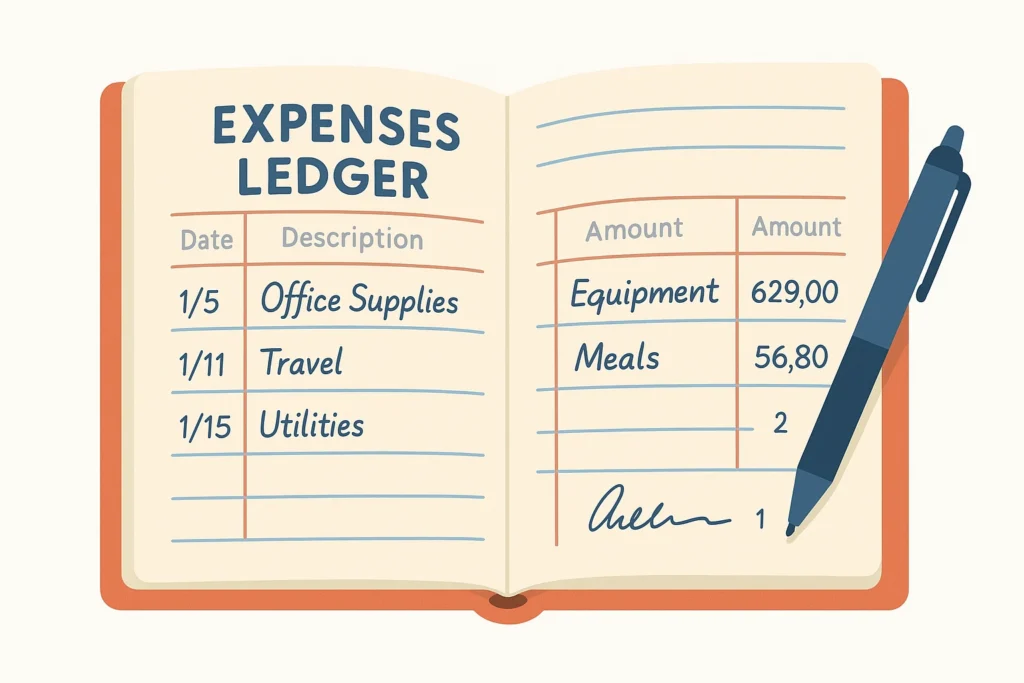

The rules for filling out the income and expense ledger depend on the form of reporting and the entrepreneur’s group. If you maintain the document in paper form, adhere to the following requirements:

- record information with a ballpoint pen in dark blue or black ink;

- write legibly and without corrections;

- any changes must be numbered and certified by the entrepreneur’s signature.

Do you need to stitch the income and expense ledger? The Tax Code of Ukraine does not require mandatory stitching. You can purchase a ready-made sample of filling out the income ledger on the internet, in stationery stores, or from the fiscal authority.

In electronic format, the income and expense ledger can be maintained in Excel or through the Electronic Cabinet of the Taxpayer. In this case, having a QES (Qualified Electronic Signature) that confirms the authenticity of the data is mandatory.

However, manual or Excel-based completion is outdated. Thanks to digital tools like HugeProfit, this process becomes even more convenient, accurate, and effective.

Mobile applications of the CRM system HugeProfit

Use all the advantages of a mobile device for inventory management:

– mobile barcode scanner

– adding sales in 2 clicks

– creating and tracking TTN

– controlling balances on Prom, Rozetka, OpenCart, Woocommerce, Khoroshop

– Many warehouses and employees

Automating Accounting with HugeProfit

The HugeProfit program significantly simplifies the maintenance of the income and expense ledger, automatically calculates tax rates, considers types of goods and services, generates reports, and unifies everything into a single system. You only need to specify the categories of income or expenses, after which the program will do everything automatically.

The service integrates with fiscal registrars (for example, Вчасно.Каса, Checkbox), which allows for automatic fiscalization of payments without additional costs for cash registers or paper receipts. This optimizes the accounting of income and expenses without unnecessary difficulties.

In the event of an audit by tax authorities, the electronic version of the income ledger should be provided along with a printout. The procedure for filling out is detailed in the Order of the Ministry of Finance No. 261.

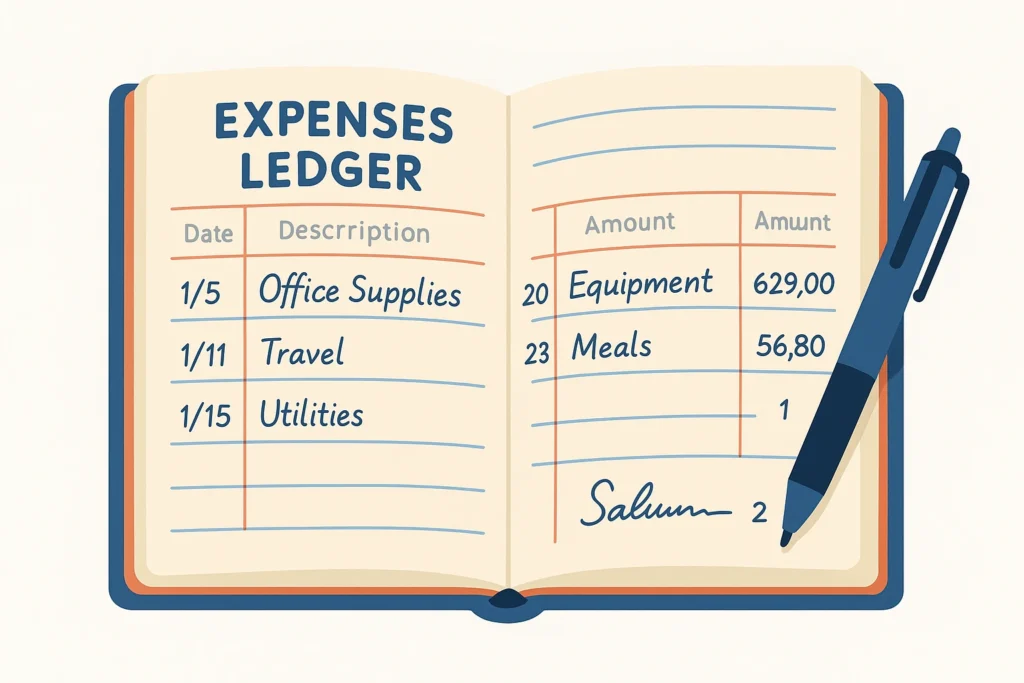

Step-by-Step Instructions: How to Maintain the Income Ledger Correctly

Filling out the income and expense ledger depends on the tax system under which the individual entrepreneur operates. Each group has its own requirements for accounting for income, expenses, and the method of filling out documentation.

For Individual Entrepreneurs on the General Taxation System (VAT Payers)

For this category of entrepreneurs, only the profit amount is taxed—the difference between actual income and documented expenses. The Ministry of Finance of Ukraine, in Order No. 261, approved the official sample of filling out the income ledger for VAT payers. Among the features, the following should be highlighted:

- Each entry in the income and expense ledger must be confirmed by an official document: a receipt, a ticket, a purchase-sale agreement.

- All amounts are indicated in the national currency—hryvnias, with the mandatory indication of kopecks.

- In case of corrections or additions to the information—new data is entered in a separate line, obligatorily certified by the entrepreneur’s signature.

- Accounting for income, expenses, and operations with goods (works, services) is carried out daily.

- Funds received in the settlement account or in cash are indicated separately.

- It is also necessary to record gratuitously received goods (services, works), labor payment expenses, social contributions, purchased materials, and services.

Correct completion of such reporting guarantees tax transparency and avoidance of fines.

Simplified Accounting: Income and Expense Ledger for the Unified Tax

For Unified Tax Payers Without VAT

Individual entrepreneurs who are not VAT payers have the option to maintain the income and expense ledger in any convenient form—either in paper form or in Excel. This format allows adapting the accounting structure to their own needs, but it is also important to agree on it with local tax authorities. Your reporting should be understandable, readable without difficulties, and contain all the mandatory details.

Despite the fact that the mandatory form of the income ledger for individual entrepreneurs was canceled in 2021, the tax authority will not object if you continue to use the old form—on the contrary, this will simplify the verification of documentation for them. The reporting should contain all economic operations and be stored properly.

For convenience in maintaining documentation, many entrepreneurs choose the search option—download the income and expense ledger in Excel, to then fill it out manually. We, in turn, suggest using automated systems, such as HugeProfit, which provides electronic templates, a flexible structure of the expense journal, and accounting for receipts in a convenient interface.

For Group 1 Individual Entrepreneurs

Legally, this group of entrepreneurs does not have the right to hire employees. However, Group 1 individual entrepreneurs can choose any convenient method for maintaining the income and expense ledger. You have the option to maintain it on paper or in electronic format. If your annual income exceeds 1 million hryvnias, you are automatically transferred to the general taxation system, so it is worth monitoring the financial limits.

The HugeProfit service allows you to track the amounts of income and expenses at any time, maintain the expense journal, and form a convenient income and expense ledger for individual entrepreneurs in the required format—with export to Excel, PDF, or to cloud storage.

For Group 2 Individual Entrepreneurs

This group allows the entrepreneur to have up to 10 employees, engage in manufacturing, trade, provide services, or run a restaurant business. The entrepreneur independently pays taxes for themselves and their employees.

Maintaining the income ledger for individual entrepreneurs is possible in any convenient form. If the annual turnover exceeds 5 million hryvnias, the individual entrepreneur will be transferred to the third group or the general system. That is why it is important to have accurate accounting data and financial control.

The HugeProfit tool provides comprehensive analytics, records income, generates reports, and allows you to maintain the income and expense ledger from any device.

For Group 3 Individual Entrepreneurs

Entrepreneurs of the third group can hire an unlimited number of employees and carry out almost any activity. If they are not VAT payers, the income and expense ledger can be filled out in any form. If the general system is chosen, the approved standard form is applied.

In case of exceeding 5 million hryvnias in turnover, the individual entrepreneur has the right to remain in the third group but will have to become a VAT payer or switch to the general taxation system.

Thanks to HugeProfit, you can:

- maintain the expense journal and income online;

- export reports to Excel, PDF;

- monitor limits by groups;

- form a sample of filling out the income ledger for any taxation system.

Regardless of the group, maintaining a correct income and expense ledger is a guarantee of a stable and legal business.

Do You Need to Register the Income and Expense Ledger with the Tax Authority?

Since 2021, Ukrainian legislation has simplified accounting for entrepreneurs: it is no longer necessary to submit the income and expense ledger to the tax authority for registration. However, this does not cancel the obligation to maintain records of income and expenses. If representatives of the controlling bodies visit you, the income and expense ledger should still be available—filled out, up-to-date, and in a form accessible for inspection.

In the event of an audit, tax authorities may require both electronic and paper versions of the report. In such a situation, electronic templates and the income and expense ledger sample completion, which you can find or create using the HugeProfit system, will be extremely useful.

Conclusion: Digital Accounting – Safer, Faster, More Convenient

Despite the cancellation of mandatory registration, the income and expense ledger remains an integral part of reporting for all individual entrepreneurs. The legislation allows filling it out in any form, including in Excel or through electronic services. Additionally, an electronic cabinet is available for all taxpayers, which simplifies the submission of reports.

Ensuring proper financial accounting of the ledger online can be done using the HugeProfit platform. It allows you to maintain accounting in a convenient digital format, automatically generate reports, record expenses and receipts, export documents in PDF or Excel formats, and store everything in the cloud.

Do you want to maintain paper documentation? You can purchase the income ledger at a stationery store or download a template. But if you choose efficiency, control, and accuracy—switch to the electronic format of financial management with HugeProfit.

Filling out the income and expense ledger is more than just a legal requirement. It is a tool for comprehensive control of your business.