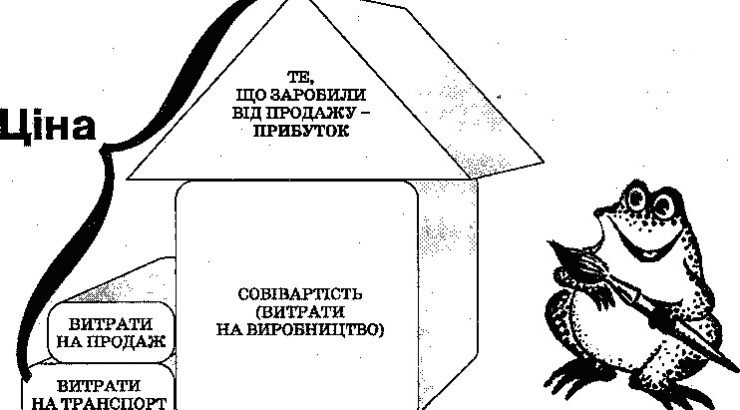

Any entrepreneur who presents his goods and services on the market must think through his pricing policy. After all, the cost of its product consists not only of the spent resources, but also of the markup. An important factor is the losses that are inevitable during the production cycle. How to find out the actual full cost of a finished product unit? For this, there is a special formula that determines exactly how to form a price tag. We will talk about this and why such calculations are needed below.

Why calculate the cost price

It is necessary to do this, because this way the businessman will understand how much he invests in the finished product or service. In this case, it is necessary to take into account many factors – from the used resources (personnel, equipment, raw materials, etc.) to transport costs and rent of premises. This is how the purchase price is formed, taking into account the costs of the enterprise.

The basis of the price policy of any enterprise is the total cost of production. This must be taken into account when calculating the cost of finished product units. Correctly calculated cost price will make the business competitive on the market, earn a real profit that corresponds to the level of development of the company. In addition, thanks to such a formula, the real loss or income of the firm is outlined.

If we look at the issue globally, three financial components depend on the cost price of the product or service:

- Trade markup. It is necessary to take into account only the own costs of production, the quality of the products produced, trends in the market. You should not focus on competitors in this matter. The price must be adequate, that is, meet the costs, demand, and capabilities of buyers.

- Marginality. A criterion showing the profitability of production. The margin indicates the difference between investments in production and the retail cost of a product unit.

- Taxation. To understand what tax must be paid to the state, you need to know how much was spent on the production of the product. Without it, there is a risk of overpayment or underpayment. In any case, the relevant services will take note of the company. According to the Tax Code, a businessman must himself calculate the unit cost of his product, determining it at each stage of production.

Finally, it is impossible to correctly report, including losses, without deducting the cost index. For example, at the initial stage of production, the price is too high. In this case, it will be necessary to issue a corresponding price tag for buyers at the final stage. In this case, it makes sense to change suppliers of raw materials, change the approach to production, revise the personnel policy, and reduce transport costs. Otherwise, the final product will not be able to compete in the market due to excessive final cost. They simply won’t buy it. This is a direct path to bankruptcy.

What else you need to know before calculating the cost price

Before looking for the cost price according to the formula, you should realistically present your capabilities. What is the initial capital of the company, what categories is the company’s budget divided into, what investments are in the FOP. Experts recommend dividing funds into categories:

- Material costs. To release a finished product, you need to pay for raw materials, utilities, and consumables. Everything that needs to be bought before starting the machines and starting directly with production fits here.

- Salary and social package. The human factor is an inevitable fact that must also be included in the estimate. When hiring people, an entrepreneur must understand that he will pay them not only salary, bonus, vacation and sick leave, but also pay for overalls, compensation in case of force majeure, incentives for holidays, and more. In addition, there is the Pension Fund, taxes and insurance – all this must be taken into account.

- Depreciation of machinery, machines and buildings, other intangible assets.

- Other losses – hire of transport from the outside, Rent of premises, advertising, freelancers.

There are two more indicators that should be distinguished: capital costs, which are reflected in the balance sheet and are included in the cost price, and costs that go to the financial statement and are not reflected in the final price.

Direct and indirect costs when calculating the cost price

As you can see, the number of factors affecting the cost price is quite large. In particular, we are talking about direct and indirect costs.

Direct directly related to the product being produced. This includes raw materials, standardization, storage, packaging, certification, and more. The wages of people engaged in the production process are also taken into account.

Indirect costs include additional costs in the production of goods or services. For example, the salary of employees who are in the staff, but do not directly participate in the production process – personnel, accountants, consultants, managers. We will also include the payment of utilities, depreciation, marking, and other costs not directly related to the release of the product.

Enterprises producing various goods should distinguish between direct and indirect costs. If a small business offers the same type of product, all costs here will be direct.

Variable and fixed costs when calculating cost

In some cases, the costs directly depend on the volume, in particular, of the initial raw materials. These are variable costs, which should also include:

- salary of employed workers;

- insurance;

- costs for packaging materials;

- additional tools, consumables, parts and more.

If there is no relationship between the number of finished units of the product and initial costs, we are talking about fixed costs. They are not subject to any external influences, be it quarantine or strike. This category includes:

- salary of employees included in the company’s staff;

- depreciation of buildings and equipment.

There is also the concept of variable costs – if an entrepreneur hires a seller, offering him not only a salary, but also a percentage of each unit sold. This indicator is taken into account in the cost only when calculating using the direct costing method.

How does the norm differ from the fact

If the business existed in ideal conditions, without force majeure and risks, it would be possible to talk only about regulatory costs. Unfortunately, such conditions do not exist, so we have to talk about actual costs. This criterion takes into account all possible freelance situations – sudden illness of an employee, price jumps, whims of transporters, forced change of suppliers.

Regulatory costs are considered at the beginning of the accounting period, since future costs are not yet known. At the end of the period, the cost price is considered, taking into account all actual expenses. The difference between these indicators qualifies as overspending or savings.

Cost calculation formula

There is an algorithm suitable for calculating any product cost:

Raw materials, materials, semi-finished products and other sources + money for wages + direct losses =

Direct Costs + costs for the full production cycle =

Production rate + expenses for sale, storage, Other warehouse services =

Full initial cost + VAT and markup =

Retail price of the product.

Next, we will consider other options for calculations using key methods and formulas.

Cost, production and other parameters – how to calculate

There are several basic methods of tools, and each entrepreneur chooses his own. Below are the most popular and common ones.

Calculation of the product cost using Excel

Excel. This is a simple program that can be mastered by anyone, even a beginner. It is available to everyone, it can be installed on any computer, and in order to work in tables, no specific knowledge is required. The user himself sets the number of rows and columns, no additional tools will be needed. You don’t even have to resort to the help of a calculator – the program calculates automatically.

An option for start-up entrepreneurs and small businesses. You will have to do a lot of calculations. In Excel, you can calculate the average cost of a product unit by dividing the monthly costs by the estimated number of products.

The second way to calculate the cost price is to divide fixed costs by the number of products in the batch, and add variable costs to the resulting cost.

Cost calculation by the Direct Coast method

Direct costing (direct cost, the method of marginal cost accounting, English direct costs) is a cost accounting method introduced by the American economist D. Harris in 1936, which consists in calculating the cost of production based only on direct (variable) costs. The essence of the direct costing system is the division of costs into fixed and variable costs.

Direct Costs. Here, the cost price can be calculated only in connection with variable costs. Regular payments go to a separate account and are debited. This method has several advantages:

- suitable for comparing benefits from the production of different products;

- will allow to effectively form prices for business goods and services;

- it is easy to find the break-even point.

Direct Costs also has its drawbacks. Thus, using this method, the entrepreneur will not be able to clearly separate the full cost of production from the cost of production. In addition, Management and accounting, most likely, will not coincide.

Calculation of cost by the method: Full cost of a unit of production.

Full cost (PC) is production costs + sales costs, that is, production cost plus non-production costs. PS will allow a businessman:

- find out the profitability of his business;

- set a retail price for a product or service;

- analyze the effectiveness of investments;

- forecast profit.

It makes sense to calculate the full cost price when the company produces a small range of goods. When the variety of items increases, it is difficult to consider variable costs.

Cost calculation by Absorption Costing method

Absorption Costing. This technique is used by many entrepreneurs and consists in the accounting of PS. With this approach, costs are considered taking into account finished products, unsold balances and blanks that have not yet left the assembly line. Using this approach, you can:

- find out the profitability of all categories of goods and services offered by the company;

- calculate the cost of inventory balances;

- accept this value as the cost per product unit.

Absorption Costing also has disadvantages. So, having a large assortment, the IP can make mistakes with the base and indirect costs. Also, constant costs for the price are out of sight – their impact on the price is difficult to calculate.

Item calculation. The method is suitable when it comes to exclusive goods – expensive cars, branded or rare items, jewelry. The main advantage of this approach is the high accuracy of calculations. However, this formula is not suitable for companies with large volumes of production.

At average cost. This method is suitable for companies that deal with constantly changing prices for raw materials and other resources. In this case, it is necessary to calculate the arithmetic average of the cost of initial codes for a certain period. The advantages of the method include:

- elementary calculations;

- suitable for a small company.

It can be used only if there is no means of automation. The method is not very accurate, and the profit is calculated approximately.

FIFO. To find out the retail price, you need to divide the cost of the lot by the number of products in it. The method will allow you to find out the price range of different suppliers. If the business has unstable purchases, this is an ideal calculation option. On the other hand, one cannot do without taking into account the product, it is necessary to supplement production with appropriate systems.

How to find the cost price

It is important to correctly report, dividing it into periods – week, month, quarter, year. Any of the methods described above can be used for the calculation. At the same time, one principle remains fundamental – all costs per party are divided by the number of units in it.

How to reduce the cost

There are several options for reducing the cost of goods. Yes, it is possible to modernize production to increase efficiency and labor productivity. Reducing the salary of management positions is another way. For this, it is necessary to cooperate with departments and expand the specialization of the company. It is important to conduct a comprehensive analysis of business assets and funds, respond to challenges and make adjustments in a timely manner.

Cost calculation by the Costing method

There are four main approaches in this method. Normative provides accounting of all indicators, including deviations from the norm. A comprehensive analysis of such deviations, search for violations, compliance with the order in production is carried out.

With the out-of-order method, a code is assigned to each product, service, batch or order as a whole. Each costing object is calculated separately. An option for companies that produce goods in small batches.

The preliminary method is used in cases where we are talking about semi-finished raw materials. In this case, the production cycle involves the transformation of the initial state of raw materials into several stages. The cost here should be considered for each stage and the results summarized.

Finally, the post-process method is used in large factories, where the production of goods is carried out continuously. In such cases, the cost of each stage is calculated, and raw materials undergoing several transformations cannot initially be considered semi-finished products.

Example

The sewing workshop offers customers only one style of dress from one type of fabric. All investments of the enterprise, including salaries, raw materials, depreciation, utilities, transport, etc., are summed up and divided by the number of dresses for the reporting period. 950,700 hryvnias / 1000 pieces = 950.7 hryvnias is the cost of one unit of finished products.

Difficulties of the method

Such an elementary formula assumes elementary output data. As soon as the assortment, nomenclature and other indicators increase, it becomes more difficult to classify costs. Accordingly, the formula will also include more components, and the calculations are carried out according to a completely different scheme. The larger the production, the more difficult the inventory and loss accounting.

So, we have outlined the most common methods of calculating the cost of goods. You can choose the one that is right for your business.